5 Battery Materials Stocks for 2023

Published 22-APR-2023 13:00 P.M.

|

10 minute read

Have you ever seen those internet adverts offering a stock market e-book if you subscribe?

Well, we made one too.

But given you are already a subscriber, here it is - you don’t have to do anything besides click the link below:

It’s called “5 Battery Materials Stocks We’ve Invested in for 2023”

We think it's a great primer on the topic of battery materials and how we’ve Invested to benefit from the ongoing battery materials boom that’s happening right now in parts of the market.

So while we’ve had some great successes Investing in lithium companies, we wanted to shine a spotlight on five NON-LITHIUM companies we are holding in the battery materials space.

We think these companies could re-rate as the market’s focus shifts to a second wave of the other critical battery materials.

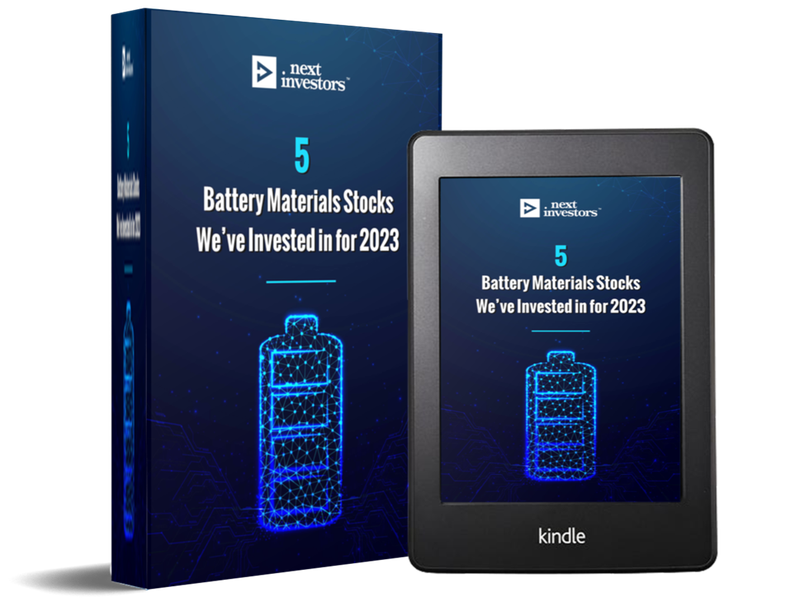

In this e-book we focus on just graphite, cobalt and manganese.

If you want to see ALL the battery materials stocks we are currently Invested in, click here.

The e-book contains information on the macro themes driving these battery materials, from supply and demand, the materials’ role in decarbonisation and electrification and the geopolitics of their extraction and processing.

It also includes profiles of five companies that we are Invested in that are working on battery materials projects:

Click here to download the e-book.

So, who are these companies featured and what have they been up to recently?

- Evolution Energy Minerals (ASX:EV1) - This week EV1 signed a framework agreement with the Tanzanian government on its DFS-level graphite project in Tanzania. Read our full take: EV1 signs Framework Agreement for graphite mine in Tanzania.

- Sarytogan Graphite (ASX:SGA) - Recently raised $5M in capital to fund metwork and development activities on its graphite project in Kazakhstan. Read our full take: SGA raises $5M in new capital.

- Kuniko (ASX:KNI) - Kuniko has been in the process of drilling three different projects aiming to hit nickel, cobalt and copper. Last month, KNI encountered visual cobalt in 5 of 6 holes. Read our full take: KNI hits “Exceptional Mineralisation” at Shallow Depth as EU launches Critical Materials Act.

- Euro Manganese (ASX:EMN) - Last week EMN’s manganese product reached target specifications at its demonstration plant in Europe, an important validation step for the company as it looks for offtake partners. Read our full take: Euro Manganese’s product is on-spec.

- Pantera Minerals (ASX:PFE) - This week PFE commenced its second round of drilling for manganese at Weelarana (45km from Element 25’s manganese deposit where auto giant Stellantis has invested). Read our full take: Drilling underway at WA manganese project.

We think the e-book provides context around our view on why we are in a decade-long investment thematic in battery materials.

Below is a quick excerpt from the introduction of the e-book:

Introduction - Why Invest in Battery Materials?

The world is mounting an all-out push to decarbonise.

And as a result of their crucial place in the energy transition, we think battery materials will be a major investment thematic for the rest of this decade.

This is why we’ve been Investing in battery materials projects for many years now.

But it’s only recently that this investment thematic has started to reach a wider audience.

We believe 2022 was the year both investors, governments and businesses really started thinking about what raw materials the world needs to make the energy transition possible.

Perhaps more importantly - actively taking steps to secure future supply of battery materials.

This push started in earnest early in 2022 and was underlined by a widely read report from McKinsey & Company - a prominent consulting firm.

The report was titled: “The raw-materials challenge: How the metals and mining sector will be at the core of enabling the energy transition”.

This report added growing weight to the calls for greater battery metals investment - and crucially, listed the various battery materials needed to make the energy transition possible.

Three of the battery materials on that list are the subject of this report - graphite, cobalt and manganese.

We’re focussing on these three battery materials because of the staggering projected growth in demand for these materials - and the urgent need for new mines/ projects to satisfy this demand.

So while another battery material, lithium, gets much of the limelight - we think there’s a second wave of energy transition stocks that could follow closely in its wake.

Today we’ll be profiling 5 stocks we are Invested in across these battery materials - these are materials which have yet to truly enter the mainstream.

But when they do enter the mainstream, we’re convinced this “second wave” will be a powerful source of major share price re-rates for the right companies with the right projects.

We’ve already seen what this type of demand for battery materials can do in our Portfolio - lithium produced our best Investment ever - Vulcan Energy Resources (ASX:VUL) which had a peak return of 8,225% for us at one stage.

VUL is driving hard at becoming a key part of the European battery materials market and achieved the rare feat of moving from a lithium explorer to a $1BN+ market capped company with $250M in the bank as of September 2022 to fund its development.

Of course, returns on Investments like VUL are exceedingly rare and few small cap companies successfully transition from explorer to developer - always remember that past returns are not indicative of future performance.

However we still try to repeat that success with our current and future Investments.

Our Investments across the three battery materials and five stocks profiled here were selected with this aim in mind.

Below is a visualisation of the average weight of raw materials that appear in a common EV battery pack chemistry:

Considering the weights involved - it gives a good sense of the magnitude of battery materials demand to come and our first topic today centres around the material used in a battery’s anode...

If you would like to read the full ebook click the link here: download ebook here.

If you want to see all the battery materials stocks we are currently Invested in, click here.

This week’s Quick Takes 🗣️

88E: new North Slope oil leases awarded

88E Updated investor presentation + forward plan

AKN: Drilling commences at Tanzanian Uranium project

FYI: Enhanced HPA output achieved ahead of offtake discussions

GTR: Second US based JORC uranium resource this quarter

KNI intersects sulphide mineralisation at Norway copper project

LNR: rare earths drilling to start in coming days

MEG: Megado reveals 415 potential pegmatite outcroppings

NHE String of Pearls: two leads become one larger lead

OKR: Okapi Resources completes geophysics

PFE: Drilling underway at WA manganese project

SGA: graphite project land access approved

Macro News - What we are reading 📰

Battery materials:

E.P.A. Is Said to Propose Rules Meant to Drive Up Electric Car Sales Tenfold (NY Times)

Nickel Revolution Has Indonesia Chasing Battery Riches Tinged With Risk (Bloomberg)

US and Europe Wrangle Over Green Subsidies to Avoid a Trade War (Bloomberg)

Forrest and IGO signal battery metals processing plant (AFR)

Expert: Cobalt Market to Stay Volatile After Record Mine Output in 2022 (Investing News)

Jaguar Land Rover to Spend £15 Billion on EVs and Autonomous Tech (Bloomberg)

The West’s fightback in critical minerals needs more than $550b (AFR)

Anglo American Scours for Opportunities to Join Copper Dealmaking Surge (Bloomberg)

Energy:

LNG producers sitting ducks as Chalmers goes where the money is (AFR)

Gold:

Evolution downgrades Canadian gold mine (AFR)

This week in our Portfolios 🧬 🦉 🏹

Evolution Energy Minerals (ASX:EV1)

This week our 2021 Wise-Owl Pick of the Year Evolution Energy Minerals (ASX:EV1) signed a Framework Agreement with the Tanzanian government for its advanced graphite project.

The framework agreement provides EV1 the all-clear to develop its graphite mine and sets out the terms and rules for making decisions about the mine.

This was a major event for the country, and now signals to the rest of the world that Tanzania is open for business.

With a newly updated Definitive Feasibility Study we hope the signed framework agreement can unlock access to financiers to help with project financing and ultimately allow EV1 to make a Final Investment Decision (FID) on its graphite project.

EV1’s updated DFS metrics are as follows:

- Net Present Value (NPV) = US$338M

- Payback Period = 3.3 years

- Internal Rate of Return = 32%

- CAPEX = US$120M

EV1 now has the all important certainty of tenure which we think will allow it to go and finance the US$120M needed to develop its project. This could be a mixture of debt or equity.

📰 See our full Note: EV1 signs Framework Agreement for graphite mine in Tanzania

Arovella Therapeutics (ASX:ALA)

After steadily climbing for weeks, our biotech Investment Arovella Therapeutics (ASX:ALA) hit a high of 10.5c on Monday after presenting a poster containing new data for CAR19-iNKT cells at the American Association for Cancer Research (AACR) Annual Meeting — one of the preeminent yearly cancer meetings.

The data indicates ALA-101 has the potential to be a novel, ‘off-the-shelf’ cell therapy to treat (CD19-expressing) leukemias and lymphomas.

It demonstrated a statistically significant lifespan extension in an aggressive leukaemia animal model, providing excellent data to support the ongoing development of ALA-101 and progression to human Phase 1 clinical trials in 2024.

Later in the week on Wednesday, ALA made the poster available to the public and presented this data to investors. While the share price pulled back from its Monday high to a current price of 6.7c in what appeared to be a case of buy the rumour and sell on the news, it remains more than double where it was trading just three weeks ago.

📰 See our full Note from Monday: ALA shows it can scale: Pathway towards an “off the shelf” cancer treatment

And ALA’s AACR Poster Presentation can be found here: ALA-101 Confers Significant Anti-Tumour Effect and Survival Benefit in Aggressive Leukemia Model

⏲️ Upcoming potential share price catalysts

Updates this week:

- 88E: Drilling for oil in the North Slope of Alaska next to UK listed Pantheon Resources.

- 88E awarded new acreage on the Alaskan North Slope. See our Quick take on the news here.

- EV1: Framework Agreement with the Tanzanian Government.

- The Framework Agreement and Shareholders Agreement for the Chilalo Graphite Project were signed this week.

- GGE: Drilling its US helium project looking for a commercially viable flow rate.

- No news out this week, but GGE entered a reading halt on Thursday pending “an announcement”.

- GTR: Maiden resource estimates across two of its uranium projects in Wyoming, USA.

- GTR announced it expects a maiden JORC resource estimate at the Lo Herma uranium project in Wyoming before the end of Q2. See our Quick Take here.

- KNI: Drilling 3/3 of its Norwegian battery metals projects in Europe.

- Sulphide mineralisation intersected in two zones at its Norwegian copper project. See our Quick Take here.

- LNR: >10,000m drill program at rare earths project in WA.

- 10,000m drilling program to commence in coming days; new outcropping ironstone trends discovered.

- NHE: Scheduled to drill two targets at its helium project in Tanzania (Q3 2023).

- NHE confirmed 2 separate leads are in fact one, large Basin Margin Fault Closure lead with a company-estimated unrisked mean Prospective Helium Resource of 22.5Bcf.

- TTM: Drilling campaign at flagship Dynasty gold project.

- New investor presentation released to ASX - click here.

No material news this week:

- IVZ: Drilling oil & gas target in Zimbabwe, Myuku-2 (Q3, 2023).

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (Q3 2023).

- GAL: Drilling at its Callisto PGE discovery in WA.

- TMR: Maiden JORC resource estimate for its Canadian gold project.

- LCL: Maiden drilling underway at primary PNG copper-gold target.

- BOD: Phase III clinical trial for CBD insomnia treatment.

- TG1: Drilling at its NSW gold project in May.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.