Vulcan's Resources Could Satisfy the EU's EV Needs

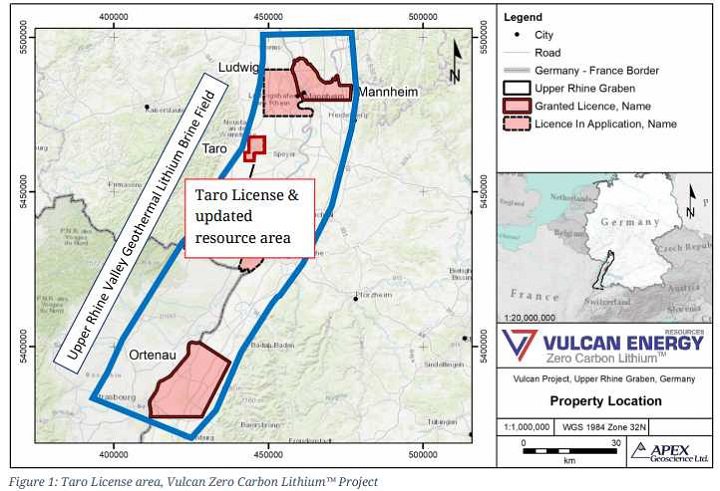

Vulcan Energy Resources Ltd (ASX:VUL; FRA:6KO) is an Australian mineral exploration company focused on exploring and developing battery metals projects in Europe. Vulcan is dual-listed on the Frankfurt Stock Exchange, trading under the code "6KO". The company’s primary asset is the Vulcan Zero Carbon LithiumTM Project in the Upper Rhine Valley of Germany, and with the Li-brine resource now estimated to collectively contain 16.19 million tonnes LCE at a grade of 181 mg/l Li (Indicated & Inferred, 90% of which is in the Inferred Resource category), it is the largest JORC lithium resource in Europe. The company’s vision is to produce the world’s first, premium Zero Carbon LithiumTM hydroxide product by 2023 and the upcoming completion of a pre-feasibility study (PFS) will be a key milestone on its path to production.

Asset Overview

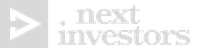

The Vulcan Zero Carbon LithiumTM Project is in close proximity to Stuttgart, the capital of the federal state of Baden-Württemberg. The area is uniquely endowed with lithium-rich hot brines. The project has an extremely large licensed package of more than 800 square kilometres.

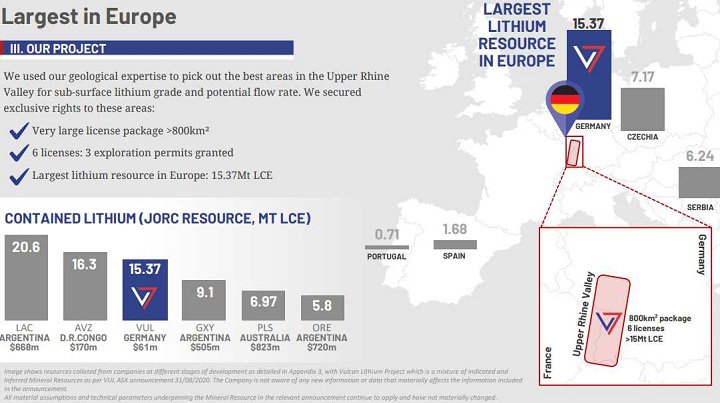

Vulcan plans to extract lithium from brine using geothermal power, via a process that generates zero net carbon emissions. Vulcan’s Upper Rhine Valley Li-brine resource was recently upgraded to collectively contain 16.19 million tonnes LCE at a grade of 181 mg/l Li (Indicated & Inferred, 90% of which is in the Inferred Resource category), making it the largest JORC lithium resource in Europe.

Vulcan will use its unique Zero Carbon LithiumTM process to produce both renewable geothermal energy and lithium hydroxide from the same deep brine source. In doing so, it is positioned to address the European Union’s (EU) challenges in dealing with a very high carbon and water footprint of production, and total reliance on imports, mostly from China.

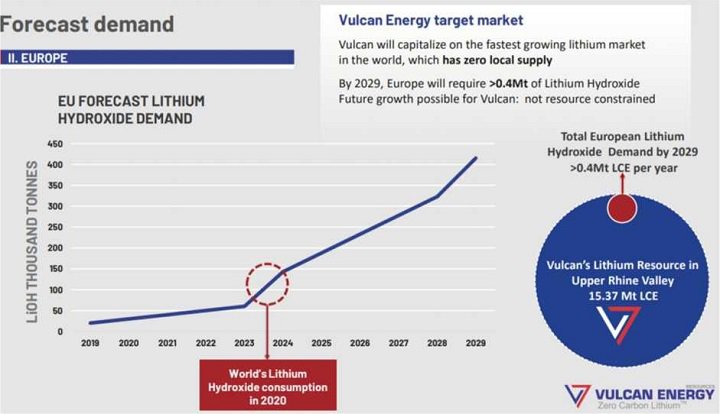

Vulcan aims to supply the lithium-ion battery and electric vehicle market in Europe, which is the fastest-growing in the world. Management is of the view that Vulcan has a resource that can satisfy a substantial portion of Europe’s needs for the electric vehicle transition, from a zero-carbon source, for many years to come.

A number of agreements are already in place to support Vulcan in advancing the project, and in May Vulcan signed a binding agreement with EIT InnoEnergy to assist with securing project funding, driving relationships, and obtaining and fast-tracking necessary licenses. EIT InnoEnergy is supported by the European Institute of Innovation and Technology (EIT), a body of the European Union.

The Taro exploration licence (the subject of a recent resource upgrade) has been granted to Global Geothermal Holding UG (GGH). Vulcan has an agreement with GGH to earn a 51% interest by spending €500,000 within two years of the license grant (Initial Expenditure). Vulcan has met this Initial Expenditure requirement. After the Initial Expenditure, a Joint Venture will be formed, with Vulcan owning 51% and GGH 49%. Vulcan will now spend a further €500,000 to earn a further 29% (Second Earn-In Expenditure) within two years, taking its JV interest to 80%.

In terms of economic viability, the project offers cost advantages due to the location. Geological factors also point to the commercial viability of the project. Brine lithium production is relatively cost-effective compared to hard rock, typically with lower operating costs. The European Union is reliant on only small or complex hard-rock projects. The exploration of the lithium resources in the Upper Rhine Valley can be sped up by the availability of existing data from decades of the previous exploration for oil and gas.

In addition, the location of the Upper Rhine Valley and immediate proximity to commercial customers offers various advantages with respect to logistical costs and supply chain efficiencies. The transportation distance to existing or planned battery factories will allow Vulcan to run a comparably low-cost production process. Combined with the substantial size and attractive grade of the resource, the project makes a compelling case that should assist Vulcan in procuring offtake and finance arrangements to advance the project.

The favourable scoping study completed in February 2020 used publicly available price assumptions. Commercial production is forecast to occur in a staged scale-up approach. Vulcan has established a model that forecasts dual revenue potential from the project. This, along with the support of the European Union-backed EIT InnoEnergy should assist greatly in terms of securing project funding, being awarded national or regional grants, permitting, and facilitating offtake agreements.

Key takeaways: largest resource in Europe, economically producing geothermal energy and lithium hydroxide, targeting a fast-growing market and aiming to produce near-term revenues through a staged development.Material developments since our initiation of coverage (June 1, 2020)

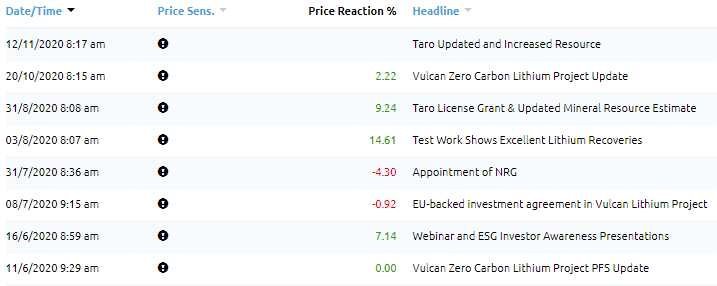

The following highlights the key operational and corporate developments that have occurred since our initiation of coverage, including the daily share price responses to the news.

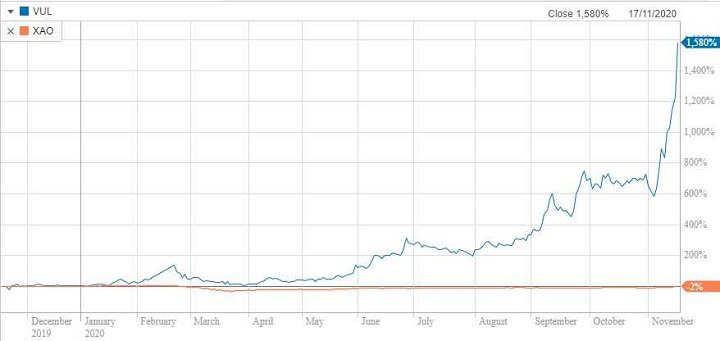

On the score of share price performance, it is worth noting that Vulcan’s shares surged to an all-time high of $2.51 on Tuesday with momentum continuing to build following last week’s release of an updated and increased resource at Taro. This represented an increase of about 50% compared with the closing price on the day prior to the Taro news being announced.

When we initiated coverage of Vulcan its share price was 34 cents, and this recent high implies a gain of approximately 640% in just over five months.

This represents a considerable outperformance relative to the S&P/ASX All Ordinaries Index (ASX:XAO) which gained about 12% over the same period.

Key Takeaway: Vulcan has been no flash in the pan story, and the following 12-month chart (as of 17 November 2020) shows that its shares have gained 1580% as opposed to a -2% decline in the XAO (orange line).

Key Drivers

June 6 and June 16 - PFS update - building investor awareness.

This was more about explaining the groundwork that had been laid to progress the PFS through the most important stages. While there wasn’t an immediate share price response, the PFS update, together with the awareness presentation on June 16 provided investors with a much clearer understanding of the highly compelling nature of the project. A key behind-the-scenes takeaway was the securing of highly respected German consultants and team members to lead this study. This provides a breadth of knowledge in the local conditions, which is critical to achieving the group’s goal of supplying the EU battery market with Zero Carbon LithiumTM products from 2023. It is worth noting that this news gained traction throughout the month of June with the company’s shares finishing up 60% by the end of the month.

8 July 2020 - EU-backed investment agreement - gaining local recognition.

While this development didn’t generate share price momentum, it should be borne in mind that the company was just coming off a strong surge in June. However, its importance can’t be understated with the direct investment by EIT InnoEnergy marking a vote of confidence in the Vulcan Zero Carbon LithiumTM Project by a prominent EU-backed body mandated to lead the European Battery Alliance.

31 July 2020 - Natural Resources Global Capital Partners Limited (NRG) appointed to provide strategic and financial advice.

As important as this was in terms of establishing a relationship with an excellent network in the global energy and metals industries, it wasn’t directly operational material or value accretive, and as such, it wasn’t market-moving news. However, four days later it was a different story.

3 August 2020 - DLE (Direct Lithium Extraction) test work shows excellent lithium recoveries.

This news was extremely material in terms of the company’s progression to identifying the best process options for the geothermal brine. With process development management continued to optimise the performance of the lithium extraction throughout its feasibility studies. This was an important step in demonstrating that geothermal brines in Europe could be both a major source of lithium hydroxide for batteries, as well as providing the renewable energy to power the extraction process, another milestone in moving to the production of Zero Carbon LithiumTM hydroxide for the European electric vehicle markets. Not surprisingly, the company’s shares finished up nearly 50% by the end of the month.

31 August 2020 - Taro Exploration License Granted, upgraded to inferred Li-Brine Resource

The granting of the Taro Exploration Licence within the Vulcan Zero Carbon LithiumTM Project in the Upper Rhine Valley Project area was an important development for the company as it also included Taro’s upgrade from an exploration target to a JORC Inferred Resource of 1.42 million tonnes contained lithium carbonate equivalent. This has recently been followed up by an updated and increased resource. However, investors were quick to strike as they recognised the significance of this development, resulting in the group’s shares increasing 80% by the end of September.

20 October 2020 - Project Update

This announcement was basically a recap of what had happened in the last month, as well as appraising investors as to what to expect in the coming months. The company’s share price had already run hard on recent news, and there was only a nominal share price increase throughout the rest of the month following management’s update.

12 November 2020 - Updated Taro Indicated and Inferred Lithium-Brine Resource & Increased Zero Carbon Lithium® Project JORC Resource

Importantly, a large portion (0.83 Mt LCE at a grade of 181 mg/l Li) of the Taro resource was upgraded to Indicated status in this announcement. This portion can thus be integrated into Vulcan’s PFS. Separately, the Inferred resource also grew to 1.44 Mt, bringing Vulcan’s Upper Rhine Valley Project (URVP) Li-brine resource’s collective estimate to 16.19 Mt LCE at a grade of 181 mg/l Li (Indicated & Inferred; 90% of which is in the Inferred Resource category), the largest JORC lithium resource in Europe. In the ensuing week, the company’s shares surged 20% to hit an all-time high of $2.00.

Company Overview

Catalysts: VUL owns Europe’s largest lithium brine resource, in the centre of the fastest-growing lithium market, with potential for further upside across its five licence areas. Following the completion of the Maiden Resource estimate and Scoping Study in just five months, accelerated development of the project is underway with a targeted completion of the PFS expected in the coming months. As the company advances the project, securing off-take and financing agreements are major catalysts.

Vulcan has an agreement with GGH to earn a 51% interest by spending €500,000 within two years of the license grant (Initial Expenditure). The company has met this Initial Expenditure requirement, allowing for a Joint Venture to be formed, with Vulcan owning 51% and GGH 49%. Vulcan will now spend a further €500,000 to earn an additional 29% (Second Earn-In Expenditure) within two years to take its JV interest to 80%.

Hurdles: Vulcan is at an early stage of its resource development and considerable further technical investigations are required to de-risk the project. Procuring finance remains a key aspect for the implementation of the zero-carbon project in the Upper Rhine Valley and there is no guarantee that funds can be procured at favourable terms. The approval process presents numerous regulatory approvals at various stages.

In terms of regulatory issues, it is worthwhile noting that the UK and European countries have made financial commitments to projects such as renewable energy (electric vehicles) due to environmental issues, as well as providing an economic stimulus post-COVID-19). As indicated below, Vulcan’s strengthened management team has a strong track record of value creation and deep experience in developing geothermal brine projects, leaving it well equipped to advance a project of such magnitude. The team includes:

- Appointment of former Tesla director Jochen Rudat to Business Development team.

- Appointment of lithium industry expert Vincent Pedailles to Business Development team.

- Appointment of lithium chemistry expert Dr. Katharina Gerber to the Executive team.

With a vision to deliver a project with a zero CO2 footprint, Vulcan targets the production of lithium hydroxide by 2023, preceded by a number of high-impact value drivers and key milestones such as the near-term completion of the PFS.

Therefore, Wise-owl reaffirms the positive stance outlined when it initiated coverage of the stock in June. It is worth noting that the company’s share price has increased from 34 cents when we initiated coverage on June 1, 2020, to $2.51 on November 17, 2020.

However, there may be more upside to come after the Pre-Feasibility Study becomes public, and when the company embarks on pursuing offtake agreements with key European auto and battery manufacturers in 2021, towards its Definitive Feasibility Study. Offtake agreements have seen peer companies such as Piedmont Lithium have major re-rates.

Read more: Tesla Unveils Strategic Battery Plans: What This Means for Our Pick of the Year

THE BULLS SAY

- Vulcan owns Europe’s largest JORC-compliant lithium resource, the Vulcan Lithium Brine Project in the Upper Rhine Valley of Germany. The Project has a Total Inferred Mineral Resource of 16.19 Mt of contained Lithium Carbonate Equivalent, at a lithium brine grade of 181 mg/l.

- With licenses (granted and applied for) covering a total area of approximately 800km2, there is potential future upside within the Vulcan Project.

- Following the completion of the Maiden Resource estimate and Scoping Study in just five months, fast-track development of the project is underway, targeting completion of the Pre-Feasibility Study (PFS) later this year.

- As the Company advances the project securing off-take & financing agreements are major catalysts.

THE BEARS SAY

- Vulcan is at an early stage of its resource development and considerable further technical investigations are required to de-risk the project.

- Procuring finance remains a key aspect for the implementation of the zero-carbon project in the Upper Rhine Valley and there is no guarantee that funds can be procured at favourable terms.

- The approval process presents numerous regulatory hurdles at various stages.

- The scoping study was based on models that forecast and increase supply, demand, and inventories, which is not guaranteed.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.