DXB is all set for Phase III interim results in March

Yesterday, our 2021 Biotech Pick of the Year Dimerix (ASX:DXB) announced that the data has been collected from the 72nd patient in its FSGS trial.

This was the last hurdle for the company to complete before the interim analysis readout on March 15th.

This interim analysis result is the first big binary result for DXB since we Invested back in 2021.

A positive result here would significantly de-risk the trial.

Here is our Bull/Bear case for these results

- Bull Case: Enough evidence to continue the trial

- Bear Case: Trial paused or stopped

A quick reminder, who is DXB?

DXB is at an advanced stage in the development of its drug, currently conducting Phase 3 clinical trials for FSGS (inflammation of the kidney).

FSGS is an orphan disease, meaning that it is eligible for accelerated approvals.

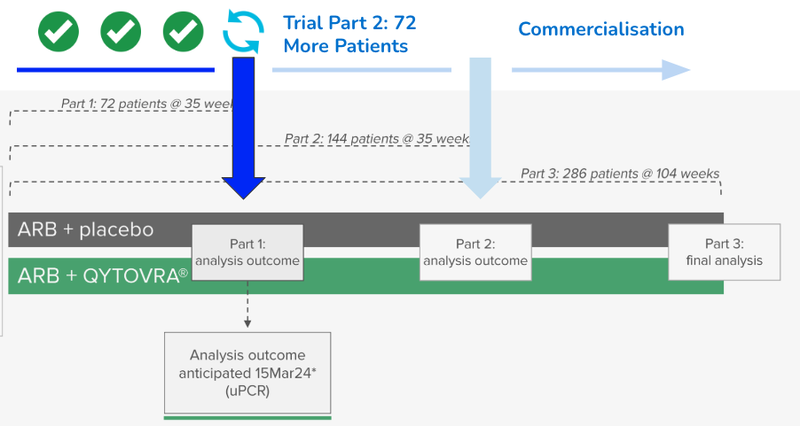

DXB’s interim Phase 3 trial results scheduled in three weeks will evaluate if there is enough evidence to suggest that DXB should continue on with the trial.

Last month DXB signed a $230M + Royalties Commercialisation Deal with Advanz Pharma for the EU, UK, Canada, Australia and NZ.

DXB is yet to sign a commercialisation deal for the lucrative US and Chinese markets.

If the trial is successful we think that commercial partners will become increasingly interested in the development given the company is so close to commercialisation.

What happens if the trial is a success?

On a successful readout, DXB’s clinical trial will be significantly de-risked.

It doesn’t guarantee that the drug will be approved, but there is evidence to suggest that it is working.

DXB will still need to continue on with the second part of its clinical trial, recruiting and dosing a further 72 patients.

After this next batch of 72 patients, DXB will likely apply to the relevant drug administration authorities for accelerated approval of its treatment for FSGS.

To fund this “Part 2” of the trial DXB had $14M in the bank at the end of December.

There are a number of different funding options that DXB could look towards to pay for the remaining costs of the trial:

- DXB has disclosed that there are “milestone payments” from Advanz Pharma. It is unclear whether a positive trial result in March would trigger this milestone, if it does however DXB could be granted some non-dilutive funding

- DXB could secure another licence deal for the US or China. Any deal with an upfront payment could also provide non-dilutive funding for DXB.

- DXB could raise capital from the market.

Either way, a positive result is what we are looking for as investors and will materially improve the risk profile of DXB.

All eyes are on the readout on the 15th of March.

Good luck to all DXB holders.