Rumours of New Battery Factory 64km away from EMH

European Metals Holdings Ltd (ASX:EMH; AIM: EMH; NASDAQ: ERPNF) is our third European battery metals investment.

We think we have found out why the EMH share price has been running the last couple of days.

EMH is developing the largest hard rock lithium resource in the EU at its Cínovec project in the Czech Republic.

We have come across some Czech news articles that look very promising for EMH investors.

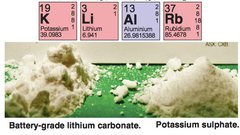

KEY TAKEAWAY - According to local media, VW and EMH’s project partner CEZ are talking about building an electric vehicle battery factory in the Czech Republic - just 64km away from EMH’s lithium project.

Does this mean EMH is getting closer to a coveted offtake agreement?

An offtake agreement would be huge news for EMH, and would likely re-rate the stock.

We don't know if this will happen, but if your local project partner is planning a battery factory down the road, we think it's pretty likely they might seek to use their own lithium.

Europe is leading the global charge to switch to EVs with mandates for localised supply chains - we are investing in this thematic via companies that are developing large scale battery metal projects inside Europe.

Our first two investments in this thematic have performed very well:

- Euro Manganese at 6.5c currently up 746% (Manganese in Czech Republic).

- Vulcan Energy Resources at 20c currently up 3,725% (Lithium in Germany).

EMH is our most recent investment in this theme.

Europe has ZERO local lithium supply and the EU is desperate to change this, which is why we like European battery metals investments.

VW has recently outlined its ambition to enter the battery raw material market - and wants to build SIX gigafactories in Europe by 2030.

Czech automaker Skoda is owned by VW and is seeking a local gigafactory in Czechia - negotiations appear very advanced on this news.

This is good news for all EU battery metals stocks - and even better for EMH, as Czech automaker Skoda is owned by VW and is pushing for a local battery gigafactory supplied by local lithium sources.

So is all this news the reason why the EMH share price started running yesterday?

We think it might be.

Here is the news article in a Czech newspaper:

A cut and paste into Google Translate reveals that:

EMH’s project partner CEZ and Volkswagen are talking about building an electric vehicle battery factory in the Czech Republic just 64km away from EMH’s lithium project.

This is huge news for EMH (full article translation is at the end of this email)

EMH’s lithium project is less than an hour drive from the proposed site of VolksWagen’s new battery factory:

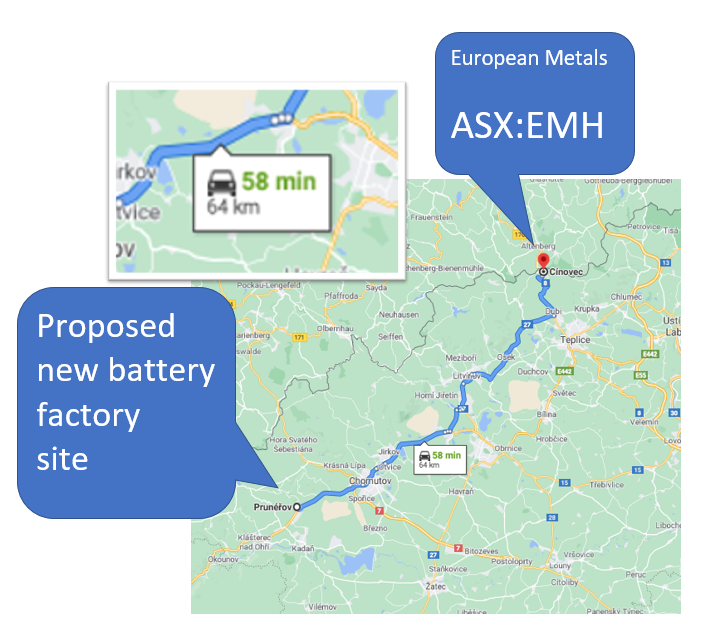

This is also great news for our Czech manganese investment Euro Manganese (ASX:EMN) who are also very close by.

This is how close EMH and EMN are to the proposed new battery factory site - all within a 3 hour drive.

EMH’s Cínovec project is located in the northern Czech Republic - the epicentre of over a dozen new and planned lithium-ion battery factories, on the doorstep of dozens of potential customers.

EMH is racing to become the first local EU battery grade lithium producer to deliver to this emerging local industry.

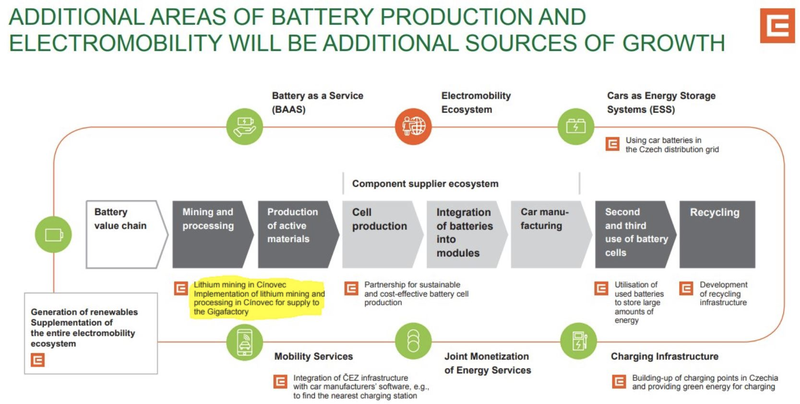

EMH shares its Cínovec project with a majority government owned local partner, the energy conglomerate ČEZ - a €10BN energy giant in eastern Europe.

ČEZ is planning to build a 'gigafactory' for batteries for cars in Czechia.

Here’s an older article that spells out the connection between ČEZ, EMH and what ČEZ is trying to achieve:

Volkswagen is a parent company of Skoda Auto, which plans to build six battery factories in Europe by 2030 - one of them most likely to be built in Czechia.Skoda intends to invest around €2.5BN in new technology, with half going to electric vehicle investment. If built, Škoda’s factory could be just 50km away from EMH’s project.

The ČEZ plant will produce batteries for electric vehicles using lithium from Czech and German mines.

ČEZ is already in discussions with Skoda to supply it with lithium.

"We are discussing with car manufacturers, we are furthest with Škoda Auto," confirmed CEZ CEO Daniel Beneš."

We’re not saying this will definitely lead to an offtake agreement for EMH, but if EMH’s project partner CEZ is a participant in a battery factory 50km from the Cínovec project, it seems a logical next step.

You can see CEZ’s full strategy here, and ‘lithium mining in Cinovec’ plays a role here (marked in yellow):

What’s next for EMH?

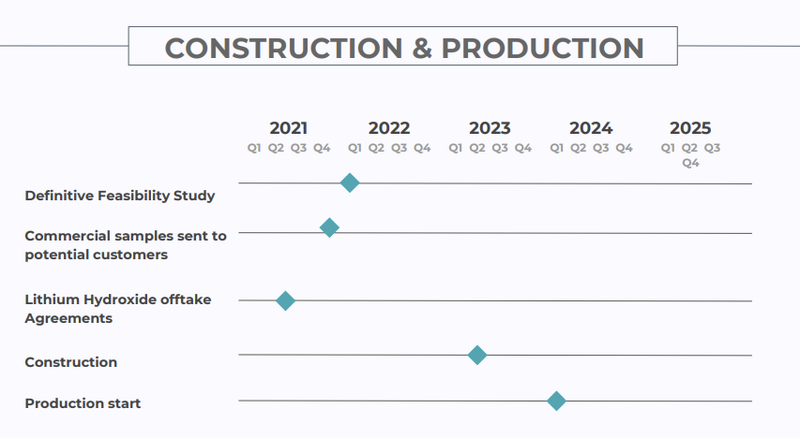

EMH outlined a timeline in its March 2021 presentation which you can see here.

If the image above is hard to read, here are the key points of what to expect in the coming quarters:

- Lithium Hydroxide Offtake Agreements - expected Q2/Q3 2021

- Commercial samples sent to potential customers - expected Q4 2021

- Definitive Feasibility Study - expected Q1 2022

- Construction - expected Q2/Q3 2023

- Production start - expected Q1 2024

Why we have invested in EMH

- The EU is very advanced in the electric vehicle market with a commitment to Net Zero emissions.

- The EU is aiming for 80% local lithium production by 2025, and beyond that, complete self-sufficiency - However the local lithium supply chain does not exist yet.

- We have done well in our EU battery metals investments so far.

- EMH’s Project located locally in the heart of Europe in Czech Republic – very close proximity to Major Automakers who are all switching to Electric vehicle production.

- EMH looks very close to getting into production as it is at an advanced stage.

- EMH looks like it is getting closer to getting an offtake agreement signed - this would be a major catalyst for the stok.

- [NEW] - VW is planning a gigafactory near EMH's project.

Original Czech news article

Link:

Full Google Translate of the article below: (with key points for EMH investors in bold.)

CEZ is preparing a giga factory

Gigafactory "for electric car batteries may be in Prunéřov, CEZ chief talks about fighting against time

PRAGUE

One week ago, Škoda Auto launched its first electric SUV, the Enyaq model. The management of the Czech carmaker is very well aware that for the further production of cars charged from the socket, it is very important that a battery factory is established in the country, which in the business world is not called anything other than a gigafactory. In total, the Volkswagen Group - the parent company of Škoda - wants to build six in Europe by 2030. According to LN, negotiations on the location of the project in the Czech Republic are on a very good path. And the most probable allies should be the Mladá Boleslav carmaker, the energy giant ČEZ and the Czech state, which will encourage the project for about 50 billion with investment incentives.

"We are discussing with car manufacturers, we are furthest with Škoda Auto," confirmed ČEZ CEO Daniel Daniel Beneš. His company is currently preparing the mining of lithium, a key raw material for the production of batteries for electric cars, at Cínovec in the Ore Mountains. It could start in three years. And it can also offer a location: the area of the former coal-fired power plant in Prunéřov. The whole effort will undoubtedly pay off. Due to the tightening standards for exhaust emissions, car manufacturers are increasingly focusing on the development, production and promotion of electric cars. And the managers of Škoda Auto know that it is advantageous to have a battery factory "around the corner" - the company has three production plants in the Czech Republic, in Mladá Boleslav, Kvasiny and Vrchlabí.

But there is also a business-interesting model elsewhere in Europe. "It's an opportunity and a struggle against time. When we fall asleep, battery factories will be established elsewhere than in the Czech Republic. All decisions of a fundamental type must be made this year, "reminded Daniel Beneš. The interim result of negotiations between ČEZ, Škoda and the state should be published in June. "So far, I can't comment on it in agreement with the actors, it's a significant investment. But it is on the right track, "said Deputy Prime Minister for the Economy Karel Havlíček (for YES) to LN. What can the state offer investors? "Working on it. It is a comprehensive and quite demanding package of direct and indirect incentives. Both from the budget and from the EU", he added.

We will replace coal in 20 years' time. Wind farms will also be established in the Czech Republic.

Author: MICHAL PAVEC

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.