BDA posts record breaking full year revenue, up 25%

Our cannabis and healthcare investment, Bod Australia (ASX:BDA) has reported its full year financial results. BDA has delivered a record breaking 25% revenue growth from the previous FY, and driven down its costs at the same time.

We have been impressed with BDA’s progress since our investment in early 2021, and are a bit perplexed as to why BDA shares have been regularly sold down since then. Maybe investors are waiting for BDA to start making a profit, or perhaps it’s because medical cannabis stocks are a little bit out of favour at the moment.

With a solid management team and strong progress being made, we think it only might be a matter of time before BDA’s share price starts to turnaround from its current near 12 month low.

We are long term investors and continue to hold all our shares since our first investment in February 2021 at 50c. We want to see a few more operating cycles and see BDA continue to deliver on its growth strategies. Hopefully, the market will soon start to take more notice.

For those new to the story, BDA is an Australian medicinal cannabis, cannabidiol (CBD), and hemp healthcare company that delivers products for the consumer and medicinal markets. It operates under two core businesses:

- Medicinal Cannabis — focused on sales of its established MediCabilis product in Australia and the UK; and

- CBD Wellness — under which all of BDA’s 30+ products are licenced to Swisse Vitamins parent company, H&H Group. These products are sold and distributed in the UK, Italy, Netherlands, Australia and the USA.

Unlike a lot of small cap cannabis stocks, BDA is already generating decent and growing revenues.

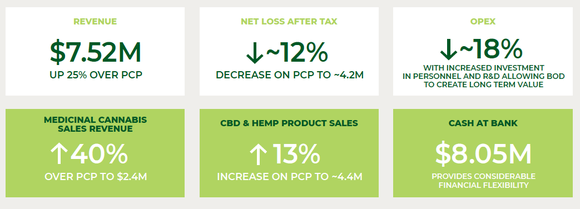

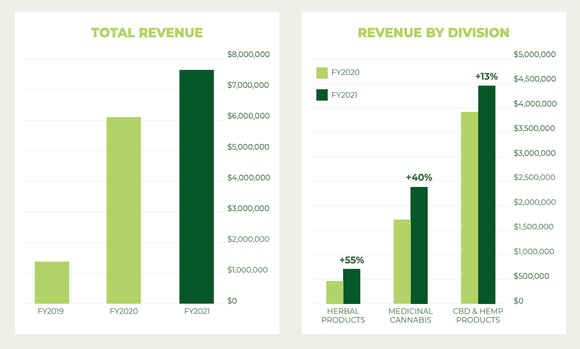

This week, BDA announced record annual revenues for FY21, a 25% lift on a year earlier, including a 40% rise in medicinal cannabis sales. While the company is yet to make a profit, its net loss for the year was reduced by 12%.

BDA’s two strong business divisions with diversified revenue streams provide access to multiple markets, a growing portfolio of products and brands backed by scientific expertise and innovation and innovative product development.

This potential suggests that BDA could be on track for a profitable 2022 (and beyond). The company’s primary focus will be organic growth, but given its strong balance sheet, including $8M in cash, we can expect the company to consider potential value adding acquisitions.

Despite its solid financial performance, since we invested in BDA its shares have been trending down — falling from 48.5 cents in February to under 30 cents. It seems that the stock was caught up in the broad decline across the entire medical cannabis sector, which appears to be temporarily out of favour amongst small cap investors.

We invested in BDA back in February, following extensive due diligence on the company and the sector and still remain confident we will get a return on our investment.

We liked BDA’s consistently growing revenue base, quality R&D core, tight capital structure and what no other peer could match — an exclusive distribution partnership with a global leading healthcare group, the $20BN capped Hong Kong-listed Health and Happiness Group (H&H — that you might know as the owner of Australia’s leading vitamin and supplements brand, Swisse). This partnership means BDA products can be sold across the globe much quicker than if they were going it alone.

BDA’s full year results to June 30 added another tick in the financial metrics box for BDA, highlighted by:

- Record annual revenue of $7.52M, up 25% on FY2020 (FY2020: $6M).

- Revenue across all business divisions up – medicinal cannabis product sales up 40% to $2.3M, CBD wellness sales up 13% to $4.39M.

- The $30M capped company is well funded with $8M cash at bank and multiple growth catalysts pending.

- Reduced operating costs by 18% on the year - so while BDA is still reporting a net loss, we like that costs are trending in the right direction.

FY Highlights

- During the year, BDA maintained a 46% market share of the total Australian market for full plant high CBD products.

- BDA also gained traction in its UK operations, securing its first medicinal sales with a scale-up now imminent.

- Another positive was that 65% of all medicinal cannabis prescriptions filled during the year were repeat patients, highlighting the quality of medicine and continued product satisfaction.

- CBD Wellness product sales accounted for $4.4M in revenue with its expansion into the USA, Netherlands, Italy, UK and Australia making way for the increased revenue.

- Deployed funds into potentially value-accretive opportunities to unlock new operating markets, underpin future product development and increase revenue growth.

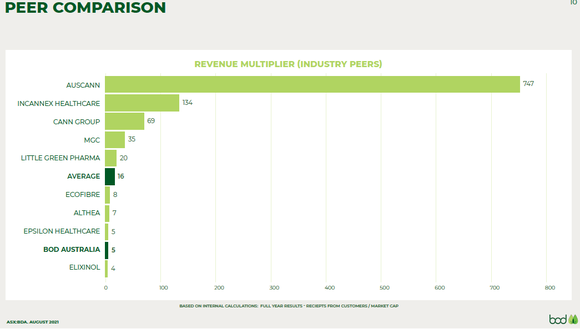

The chart above illustrates the revenue multiplier of some ASX listed medical cannabis companies. Essentially, it compares the value of a company’s equity relative to its revenues over the past 12 months.

All else being equal, companies trading at lower revenue multiples are considered undervalued relative to those trading at high multiples of revenues. BDA is one of the most undervalued amongst its peers. What is neglected in this chart is future growth potential, and we are hoping for a lift for BDA in this department too.

As long term holders, whilst the share price is down, we take comfort in the matters that BDA can control - and from this point of view the company has never been in better shape.

✅ Cashed up - $8.05M at 30 June 2021

✅ Topline revenue growth

✅ Established and expanding global sales footprint

✅ Strong medicinal cannabis product growth

✅ Dominant domestic position for medicinal cannabis

While we are disappointed that BDA is trading at 52 week lows, we believe that it is being unfairly tarnished with the same brush impacting the entire sector.

We haven’t sold a share since we first invested. With revenues growing and plenty of catalysts ahead, and BDA shares trading at near 12 month lows, we think there is upside in BDA at current levels.

What’s coming up?

- Progress US market entry with H&H following receipt of initial binding purchase order.

- International market and product expansion with H&H under new and existing brands

- New product launches under the CBII brand in the US, UK and other established markets.

- Continued growth of MediCabilis prescription sales in Australia, as well as scale up of UK operations.

- R&D initiatives to further build on the growing body of evidence for the use of MediCabilis TM.

- Finalise product registration strategy for new schedule 3 CBD products in the Australian market.

- Start trials to test the efficacy of its medicinal cannabis product suite in the treatment of long-COVID-19.

- Potential complementary acquisitions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.