FYI’s Project of National Significance, says Australian Federal Government

Published 29-JUN-2021 13:10 P.M.

|

4 minute read

Our recent investment FYI Resources (ASX: FYI) has just been awarded "Major Project Status" from the Australian Federal Government, having been endorsed as a project of "National Significance".

But what does this mean exactly?

For starters, FYI gets direct access to the very top tiers of the Federal Government - the Minister.

FYI will go straight to the top of the queue when it comes to permitting and approvals - as it is effectively ‘pre approved’.

This endorsement from the Federal Government will open up financing options significantly as well as regulatory risk is vastly reduced.

This news comes with just 36 days to go until we get material information on FYI’s potential JV with the world’s largest alumina producer US$6.7 Billion Alcoa.

FYI intends to make High Purity Alumina in Western Australia and export it to China, Japan, South Korea, Taiwan, Europe and North America

High Purity Alumina is increasingly used in Electric Vehicle (EV) batteries and energy storage, as well as established industries including LED lighting and semiconductors.

FYI will take aluminous kaolin clay from its large resource located in WA, then transport it to a HPA production facility in Kwinana, where up top 10,000 tpa of HPA is intended to be produced.

We invested in FYI as we like the battery metals thematic, and the company is in an advanced stage of development.

Australian Government now Endorsing FYI’s Project

This endorsement by the Federal Government is more than just kudos for FYI’s project - here are the benefits:

- FYI gets a direct point of access into government - the Minister. This should expedite FYI’s permitting and approvals process. FYI’s applications won’t go to the bottom of the pile like any other project - FYI’s applications will be virtually received and be ticked off straight away, as FYI is ‘pre approved’.

- FYI will be a front runner for certain financing options. FYI will now get priority access to various financing options such as export credit, government grants, R&D grants, and rebates.

- Federal Government support provides confidence to offshore investors. There are access and cost of capital advantages to FYI now.

- Assists and supports FYI’s ESG goals.

- Opens doors to potential customers for its product. This is via the Austrade network.

- Assists FYI on a Government to Government approach in facilitating its long term strategy in other jurisdictions.

This government endorsement is another tick in our investment box.

What's happening to the FYI share price?

We entered FYI in May 2021 when it was trading at 46c.

Since then the stock has been as high as 72.5c, and is now hovering around the 50c mark.

We haven't sold a share as we are long term holders and invested to see FYI execute on its strategy.

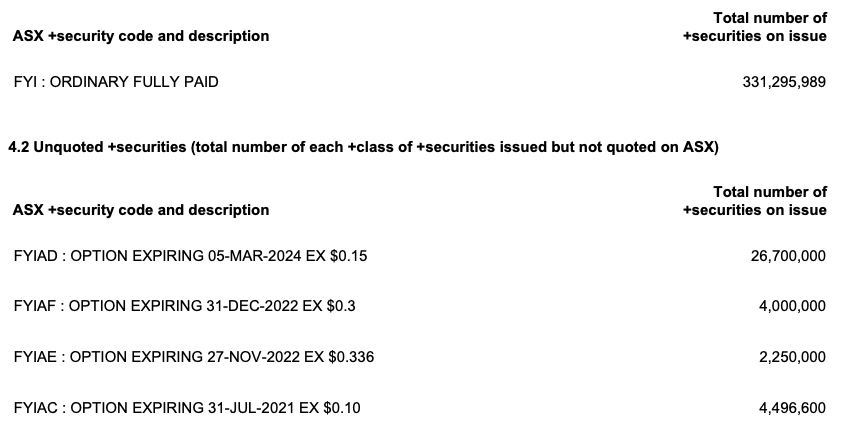

FYI has ~ 331M shares on issue, along with ~ 37 unexercised options that are currently in the money.

Here is FYI’s current capital structure:

If all options are converted, this would bring in over $5.2M to FYI, however, the options have appeared to have created a natural weight to the FYI share price around current levels.

Until the majority of these options are converted, FYI may trade sideways for a while - unless a major share price catalyst occurs.

Here’s why we invested in FYI

FYI is currently capped at $170M – and a recently updated Definitive Feasibility Study demonstrated its project can deliver a Net Present Value of over A$1.3BN.

We invested in FYI for four key reasons:

- FYI is leveraged to the "Battery Metals" thematic. We have done well in this space before.

- FYI’s development project is at an advanced stage. FYI’s Definitive Feasibility Study demonstrated an NPV of over A$1.3BN.

- FYI is in exclusive talks with Alcoa on a potential JV . Both companies entered into a 90 day exclusivity period - there is only a few weeks to go til we find out.

- FYI has a cheaper and less energy intensive process for HPA production. FYI’s HPA production is cheaper and has less carbon emissions than its peers.

We think FYI is well positioned to bring its HPA plant into a reality over the coming years, after demonstrating all the project’s credentials over recent months.

Next FYI Catalyst - News of the Potential Alcoa JV - due in the coming weeks

FYI is currently in exclusive negotiations with Alcoa Australia Ltd on a potential JV that would accelerate development of its project.

Alcoa Corporation (NYSE: AA) is one of the world’s largest alumina producers and a Fortune 500 company.

FYI and Alcoa started negotiations on 5 May under a 90-day exclusivity period.

We are now almost two months into this period ( just 36 days to go ) with negotiations expected to touch on the terms of a potential JV as well as the technical and commercial viability of the JV.

Given the surge in HPA demand driven by its use in lithium ion batteries, we are hoping that FYI can capitalise on this over the coming years.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.