AJX Announces First Body Armour Contract - Breaks into New Market

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 6,178,333 AJX shares at the time of publication. S3 Consortium Pty Ltd has been engaged by AJX to share our commentary on the progress of our investment in AJX over time.

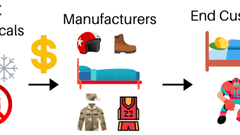

Our investment Alexium International (ASX:AJX) has developed - and is selling - advanced performance chemicals for cooling and fire resistance.

AJX commercialises its advanced performance chemicals by partnering with and selling its technology to manufacturers in a specific market (bedding, textiles, military uniforms etc).

AJX's partners then on-sell products to end customers with the AJX chemicals applied.

Today, AJX announced the FIRST commercialisation of its cooling technology in the BODY ARMOUR segment, partnering with US-based manufacturer, Premier Body Armor.

Today’s news is a big milestone for AJX as it confirms the company's expansion of its cooling technology products into the US body armour market - successfully executing on its strategy.

With the first customer secured, we think AJX is well positioned to grow this market segment and sell its cooling technology into adjacent markets.

This means that if AJX can show customers its cooling tech works in one area, it can pick up sales in similar or ‘adjacent’ markets.

It goes like this... you’ve seen how our cooling tech works for body armour, why not try it out in your uniforms etc?

Here’s why we like today’s AJX announcement...

We think there are three primary reasons why today’s announcement is positive:

- It adds another revenue stream for AJX to go after: The new market segment has an addressable market in the US of +US$25M per year. We actually think AJX has understated this addressable market and is being conservative here.

- It provides validation of the advantages of AJX’s performance chemicals.

- It shows that AJX can execute on a strategic vision.

Long time AJX investors will know that the backbone of its revenue is supported by selling its performance chemicals to bedding manufacturers.

Indeed, US$5.3M of the US$7.2M of revenue (~74%) that AJX reported in FY2021 was from the bedding segment.

While there is still growth in the bedding market, it is a mature market, so without penetration into new markets AJX’s growth would have been limited.

This is why AJX took the strategic decision to enter into new markets with its adaptive cooling technology, increasing the size of the revenue prize.

Today’s announcement marks the first revenues in the ‘body armour’ market and a big achievement for the company executing on its business plan.

We think that this is only the beginning for AJX, and we are looking forward to seeing how this new commercial venture will support AJX’s overall goal of being cash flow positive in FY22.

How do we track our AJX investment?

We are generally watching for AJX to create → prove → commercialise new chemistries for cooling and flame resistance in different consumer markets.

Those different consumer markets range from bedding, clothing, uniforms, upholstery, sporting goods, to many other consumer market segments.

Here are our basic “Create → Prove → Commercialise” process steps for each new market AJX wants to enter:

- Identify a new market (i.e. bedding, uniforms, body armour, etc...).

- Design/combine AJX chemistries for end use in this new market.

- Successful testing: confirm the new chemistry combination and manufacturing process works.

- Sign Manufacturer Partnership #1: A product manufacturer agrees to use AJX chemistry in their end products.

- Sign Manufacturer Partnership #2: Second manufacturer proves there is a strong market.

- First product revenue: Initial cash generated.

- Increased revenue: More cash generated.

- Multiple end uses in market: Develop new uses in the newly established market.

Today, AJX announced it has signed a partnership and production testing agreement with Premier Body Armor that should (hopefully) lead to first revenues for this segment.

While today’s announcement does not contain specific information regarding revenue from Premier Body Armor, we expect the relationship between the two companies to positively impact revenue going forward.

The total US body armour manufacturing market is worth US$632M - so we’re curious as to what kind of revenue AJX can derive from this new venture.

AJX says its addressable market is worth US$25M, which represents the portion related to cooling technology as part of the larger body armour market.

It is often difficult for businesses to secure that initial sale.

But once AJX can prove that its technology works - and that customers are willing to pay for it - we think it will open the doors to further opportunities, potentially in the lucrative US defence market.

Military organisation contract wins from here?

We don’t think it's out of the question, should the right pieces fall into place for AJX.

Who is Premier Body Armor?

Premier Body Armor is a “direct to consumer” body armour manufacturer and retailer based in Gastonia, North Carolina close to AJX’s operations.

Premier Body Armor customers have included:

- The United States Special Operations Command,

- The United States Marine Corps,

- North American and international OEM’s,

- Private security industry,

- Government agencies,

- The Department of Defense.

We think Premier Body Armor is a good fit for AJX and given their previous sales in the US defence industry, we believe it's possible that this could unlock this larger market for AJX.

How AJX’s Cooling Technology Works

AJX’s EclipsysTM cooling technology is perpetual and adaptive - drawing heat away from the user.

The cooling properties of EclipsysTM don’t dissipate over time and the chemical additive works harder the hotter you get.

This is actually an exciting development in the chemicals space and is a massive point of difference for AJX’s product from the rest of the market.

AJX has data which demonstrates that ‘the patent pending technology continually pulls heat away from the user, cooling [body armour wearers] by up to 200% more than competing products.’

Furthermore, ‘Human studies have been conducted and early test data has shown that the [technology] reduces the heat index of the wearer’s microclimate by more than 10 °F.’

10 degrees Fahrenheit may not sound like all that much, but it's a significant drop in temperature - something we think would provide a commercial advantage for AJX in the market.

Imagine you are a first responder or security guard working in a hot environment with the temperature outside sitting at 30 degrees Celsius, and on top of that you have to wear constricting metal plates around your torso to protect you.

In that situation it’s not just about comfort, it's about being able to perform your duties effectively.

Heat stroke and exhaustion are real threats to your operational capacities as a first responder.

With AJX’s cooling technology, instead of it feeling like 30+ degrees Celsius outside, it feels more like 24 degrees Celsius - a tangible difference.

AJX’s financials: operating cash flow positive soon?

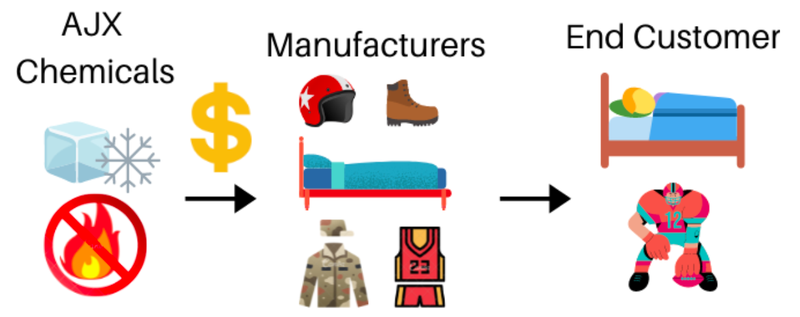

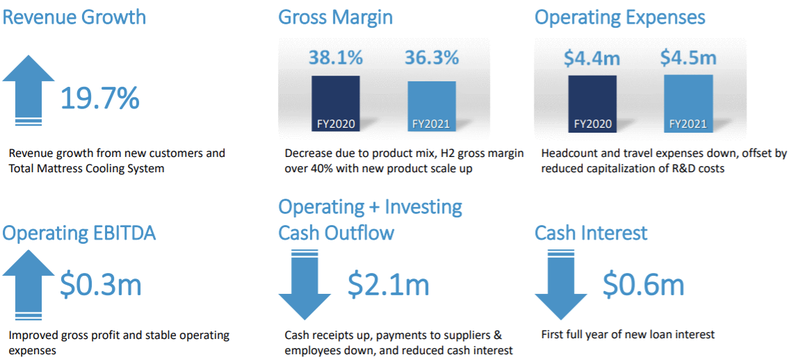

AJX is advancing its business plan, and could become operating cash flow positive in the coming three quarters or less:

As you can see, AJX has already got positive earnings (EBITDA) and solid revenue growth of 19.7%.

The next major step is to become operating cash flow positive, which we think is definitely on the cards in the next two quarters.

This would mark a significant milestone for AJX as it indicates to investors that the business is sustainable.

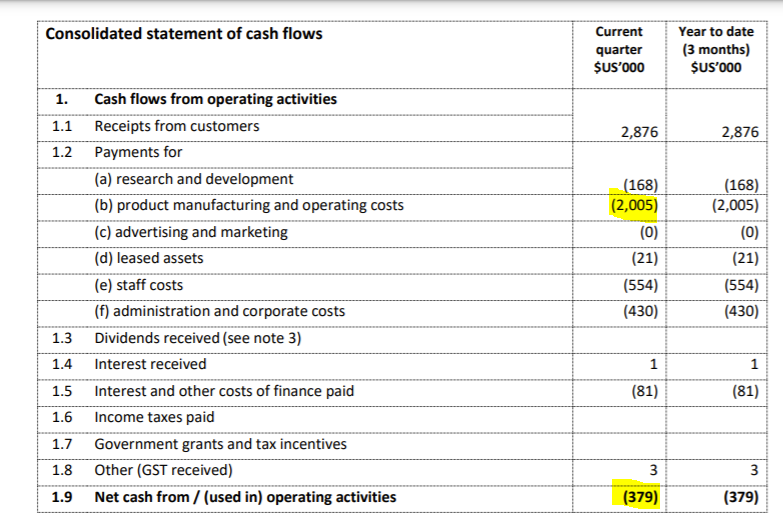

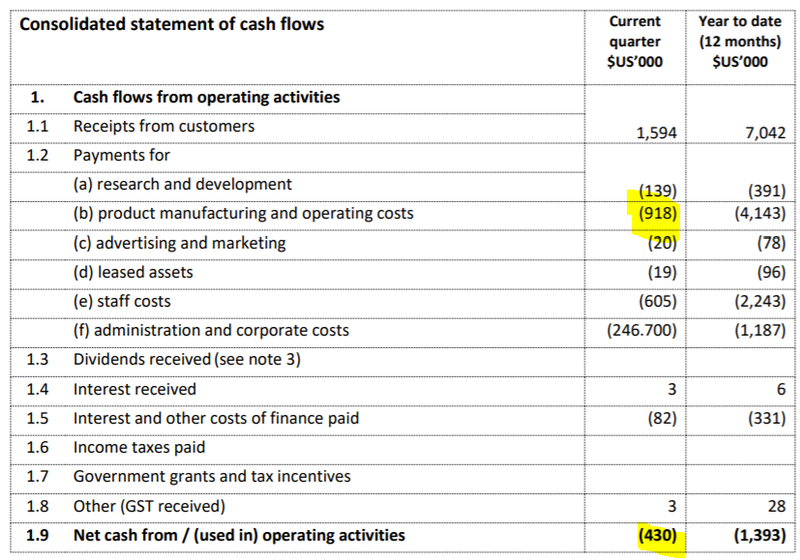

Here’s the operating cash flows from the September quarter:

Compared with the June quarter:

AJX has shaved off some of its operating outflows, while dramatically increasing its product and manufacturing costs.

That increase is fine in our book as it's a sign that AJX are ramping up for more sales.

It should have more inventory on hand to close these sales and with the body armour market - a new source of revenue.

With added demand from a new market segment, we think operating cash flow positive status is possible in the next three quarters or quarters with this quarter being the stretch goal. This is something we highlight in our investment milestones for the company.

Our AJX Investment Strategy:

We’ve launched a new way to look at a company called “Investment Memos.” These are a quick and easy way to get up to speed on companies like AJX. You can read our AJX investment memo which covers our investment thesis form when we increased our position in July earlier this year.

We initially invested in AJX at 6¢ and retain 72.54% of our total position.

✅ Initial Investment: @ 6c

✅ Increased Position: @ 6c

✅ Increased Position: @ 5.49c

🔲 Price increases 500% from initial entry

🔲 Price increases 1000% from initial entry

🔲 Price increase 2000% from initial entry

✅ 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Profit

🔲 Hold remaining Position for next 2+ years

What do we want to see next from AJX?

Next we want to see:

- Revenue growth in the December quarterly.

- Additional revenues announced in the Body Armour segment (beyond today’s announcement).

- News regarding developments in new market segments either in cooling technology or flame resistance technology.

- BONUS (stretch goal): if the company is cash flow positive at the end of this quarter.

🧊 Cooling Market 2: Body Armour

✅ Intent to enter a new market

✅ Design/Combine AJX chemistries

✅ Successful product testing

✅ Sign Manufacturing Partnership #1

🔲 Sign Manufacturing Partnership #2

🔄 First Revenue

🔲 Increased Revenue

🔲 Develop multiple end uses in market

Alexium International Company Milestones

✅ Portfolio Launch

📅 Revenue Up 20% (FY21 Results)

📅 [NEW] Sales Revenue up 40% Cash Receipts up 70% (Jun-Sep Quarter 2021)

🔄 [NEW] Continued upward sales trend (Oct-Dec 2021 quarter)

🔲 Continued upward sales trend (Jan-Mar 2021 quarter)

🔲 EBITDA Positive (Jan-Mar 2021 quarter)

🔲 Cash Flow Positive (Apr-Jun 2022 quarter)

🔲 Unexpected Positive Announcement 1

🔲 Unexpected Positive Announcement 2

✅ New Technology Development 1: Perpetual Cooling

✅ New Technology Development 2: Biobased Cooling Material

🔲 New Technology Development 3

🔲 New Technology Development 4

🔲 New Technology Development 5

🔲 New Technology Development 6

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 6,488,333 AJX shares at the time of publication. S3 Consortium Pty Ltd has been engaged by AJX to share our commentary on the progress of our investment in AJX over time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.