Emerging Companies: Astro Japan Property Group (ASX: AJA)

Published 24-OCT-2013 00:00 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

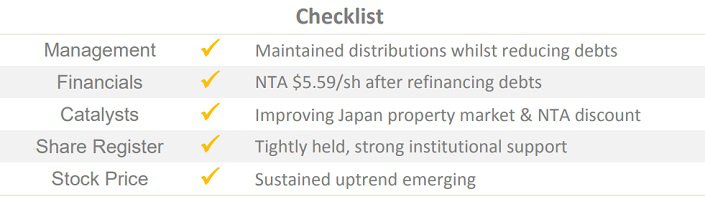

Overview: Astro Japan Property Group ("Astro Japan", ‘the Group") is an investment vehicle focused on the Japan real estate market. It currently holds interests in a portfolio comprising 36 retail, office, and residential properties, of which 80 percent are situated in central and greater Tokyo. After encountering balance sheet issues for the past five years, we initiate coverage for its turnaround potential.

![]()

Catalysts: Completion of refinancing initiatives post June 30 th are expected to see Astro Japan’s statutory Net Tangible Asset ("NTA") backing lift from $3.75/sh to $5.59/sh. Reduced interest costs also drive a forecast 20 percent rise in FY14 distributions to 20c/sh. With the Group witnessing valuation gains in its portfolio for the first time since 2008, emerging stability within the Tokyo property market could narrow Astro Japan’s NTA discount. Every one percent change in portfolio value impacts NTA by two percent.

Hurdles: NTA discount stems from ten consecutive half-year periods of valuation contractions within Astro Japan’s portfolio, and a two-decade trend of declining national urban land values. Whilst borrowings now stand at manageable levels, debt servicing consumes a significant proportion of operating income, constraining distribution payouts. With cancellable leases making up 47% of income, distribution stability is not assured.

Investment View: Government initiatives to reinflate Japan’s economy could alleviate two decades of structural real estate market declines. Astro Japan is positioned to benefit after rationalising its portfolio and recapitalising its balance sheet. Attracted to its income profile and capital growth potential stemming from a 35 percent discount to NTA, we initiate coverage with a ‘buy’ recommendation.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.